Crypto Batter– Cryptocurrency has rapidly evolved from a niche digital experiment to a major financial phenomenon, reshaping how we think about money, transactions, and investment. The world of cryptocurrency, while complex, offers a wealth of opportunities for those willing to dive in and explore its potential. This article aims to provide an in-depth understanding of why cryptocurrencies are considered better in many aspects than traditional financial systems. We’ll explore the evolution, advantages, challenges, and future potential of cryptocurrencies, providing you with the knowledge needed to navigate this exciting new frontier.

What is Cryptocurrency?

At its core, cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments (like the US dollar or the Euro), cryptocurrencies operate on decentralized networks based on blockchain technology—a distributed ledger enforced by a network of computers, known as nodes.

The first and most well-known cryptocurrency, Bitcoin, was created in 2009 by an anonymous entity known as Satoshi Nakamoto. Bitcoin was designed as a peer-to-peer electronic cash system, allowing for secure and anonymous transactions without the need for a central authority, such as a bank or government. Since then, thousands of other cryptocurrencies have been developed, each with its unique features and use cases.

The Evolution of Cryptocurrency

The evolution of cryptocurrency can be traced back to the early 1980s, when cryptographers began exploring the idea of anonymous electronic money. However, it wasn’t until the launch of Bitcoin in 2009 that the concept gained traction. Bitcoin’s introduction marked the beginning of a new era in finance, offering a decentralized alternative to traditional monetary systems.

Over the past decade, the cryptocurrency landscape has expanded dramatically. New cryptocurrencies have been created, each addressing specific issues or offering unique advantages. For example, Ethereum introduced the concept of smart contracts, enabling automated and self-executing agreements on the blockchain. Ripple (XRP) focused on facilitating fast and low-cost international payments.

The rise of decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and blockchain-based applications has further expanded the utility and appeal of cryptocurrencies, making them a central part of the digital economy.

Why Cryptocurrencies are Better

Decentralization

One of the most significant advantages of cryptocurrencies is their decentralized nature. Traditional financial systems rely on centralized authorities, such as banks or governments, to issue currency and oversee transactions. This centralization can lead to issues such as corruption, inefficiency, and the potential for censorship.

Cryptocurrencies, on the other hand, operate on decentralized networks where no single entity has control. This decentralization ensures that transactions are transparent, tamper-proof, and resistant to censorship. It also means that users have greater control over their funds, as they are not reliant on intermediaries to conduct transactions.

Security and Transparency

Cryptocurrencies use advanced cryptographic techniques to secure transactions and protect users’ funds. Blockchain technology, which underpins most cryptocurrencies, is designed to be highly secure and transparent. Each transaction is recorded on a public ledger, which can be viewed by anyone but cannot be altered or deleted.

This transparency reduces the risk of fraud and provides a level of accountability that is often lacking in traditional financial systems. Additionally, because cryptocurrencies are secured by complex mathematical algorithms, they are resistant to counterfeiting and other forms of manipulation.

Global Accessibility

Cryptocurrencies have the potential to provide financial services to individuals who are underserved or excluded by traditional banking systems. According to the World Bank, nearly 1.7 billion people worldwide are unbanked, meaning they do not have access to a bank account or other financial services.

Cryptocurrencies can be accessed by anyone with an internet connection, regardless of location or socioeconomic status. This global accessibility makes it easier for people in developing countries to participate in the global economy, send and receive money, and access financial services that were previously out of reach.

Lower Transaction Fees

Traditional financial transactions, especially cross-border payments, can be expensive and slow. Banks and payment processors often charge high fees for transferring money across borders, and transactions can take several days to settle.

Cryptocurrencies, however, offer a more cost-effective and efficient alternative. Because they operate on decentralized networks, there are no intermediaries to charge fees or slow down transactions. As a result, cryptocurrency transactions are typically faster and cheaper than traditional financial transactions, making them an attractive option for both individuals and businesses.

Inflation Resistance

Many cryptocurrencies have a fixed supply, meaning that there is a limited amount of currency that can ever be created. For example, Bitcoin has a maximum supply of 21 million coins, which ensures that it cannot be inflated by creating more coins.

This fixed supply makes cryptocurrencies resistant to inflation, a common issue with traditional currencies. Governments can print more money at will, leading to inflation and a decrease in the purchasing power of the currency. Cryptocurrencies, by contrast, offer a more stable store of value, as their supply is determined by transparent and predictable rules.

Popular Cryptocurrencies

While there are thousands of cryptocurrencies available today, some have emerged as leaders in the market, each offering unique features and benefits. Here are a few of the most popular cryptocurrencies:

Bitcoin

Bitcoin (BTC) is the first and most well-known cryptocurrency. It was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin is often referred to as “digital gold” because of its limited supply and its role as a store of value.

Bitcoin operates on a decentralized network, where transactions are verified by network nodes through cryptography and recorded on a public ledger known as a blockchain. As the original cryptocurrency, Bitcoin has the largest market capitalization and is widely accepted as a means of payment and investment.

Ethereum

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization and is known for its smart contract functionality. Unlike Bitcoin, which is primarily a digital currency, Ethereum is a decentralized platform that enables developers to build and deploy decentralized applications (dApps) on its blockchain.

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute when the conditions of the contract are met, eliminating the need for intermediaries. This functionality has made Ethereum the foundation for many DeFi projects and NFTs.

Ripple (XRP)

Ripple (XRP) is a cryptocurrency designed for fast and low-cost international payments. Unlike Bitcoin and Ethereum, which operate on decentralized networks, Ripple is a centralized digital currency, created and managed by Ripple Labs Inc.

Ripple’s primary use case is to facilitate cross-border payments between financial institutions. It aims to provide a more efficient alternative to traditional payment systems like SWIFT, offering faster settlement times and lower transaction fees.

Litecoin

Litecoin (LTC) is often referred to as the “silver to Bitcoin’s gold.” It was created by Charlie Lee in 2011 as a lighter and faster version of Bitcoin. While Litecoin shares many similarities with Bitcoin, it offers faster transaction times and a different hashing algorithm.

Litecoin is widely used as a medium of exchange and is accepted by many merchants and payment processors. Its faster transaction times and lower fees make it an attractive option for everyday transactions.

Cardano

Cardano (ADA) is a third-generation cryptocurrency that aims to address some of the scalability and sustainability issues faced by earlier cryptocurrencies like Bitcoin and Ethereum. Cardano was developed by a team of academics and engineers led by Charles Hoskinson, one of the co-founders of Ethereum.

Cardano uses a proof-of-stake (PoS) consensus mechanism, which is more energy-efficient than the proof-of-work (PoW) mechanism used by Bitcoin. The platform also focuses on interoperability and scalability, making it a promising option for developers looking to build decentralized applications.

How to Invest in Cryptocurrency

Investing in cryptocurrency can be a rewarding experience, but it’s essential to approach it with caution and a clear strategy. Here are some steps to get started:

Choosing the Right Exchange

The first step in investing in cryptocurrency is to choose a reputable cryptocurrency exchange. An exchange is a platform that allows you to buy, sell, and trade cryptocurrencies. Some of the most popular exchanges include Binance, Coinbase, Kraken, and Bitfinex.

When choosing an exchange, consider factors such as security, fees, available cryptocurrencies, and user experience. It’s also important to ensure that the exchange is compliant with local regulations and has a good reputation in the industry.

Creating a Wallet

A cryptocurrency wallet is a digital tool that allows you to store, send, and receive cryptocurrencies. There are several types of wallets available, including hardware wallets, software wallets, and mobile wallets.

Hardware wallets, such as the Ledger Nano S and Trezor, are physical devices that store your cryptocurrency offline, making them highly secure. Software wallets, such as Exodus and Electrum, are applications that you can install on your computer or mobile device. Mobile wallets, such as Trust Wallet and Mycelium, are apps that allow you to manage your cryptocurrency on the go.

It’s essential to choose a wallet that meets your needs and provides the necessary security features to protect your funds.

Security Best Practices

Security is paramount when investing in cryptocurrency. Here are some best practices to keep your funds safe:

- Use Two-Factor Authentication (2FA): Enable 2FA on your exchange account and wallet to add an extra layer of security.

- Keep Your Private Keys Secure: Your private keys are the keys to your cryptocurrency holdings. Store them securely and never share them with anyone.

- Be Wary of Phishing Scams: Scammers often try to trick users into revealing their private keys or login credentials through phishing emails or fake websites. Always verify the authenticity of the website or email before entering any sensitive information.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different cryptocurrencies to mitigate risk.

Risks and Challenges of Cryptocurrency

While cryptocurrencies offer numerous advantages, they also come with risks and challenges that investors should be aware of:

Market Volatility

Cryptocurrency markets are known for their extreme volatility. Prices can fluctuate significantly within a short period, leading to substantial gains or losses. This volatility can be attributed to factors such as market sentiment, regulatory news, technological developments, and macroeconomic trends.

Investors should be prepared for the possibility of significant price swings and avoid investing more than they can afford to lose.

Regulatory Risks

Cryptocurrencies operate in a regulatory gray area in many countries. While some governments have embraced cryptocurrencies, others have imposed strict regulations or outright bans. Regulatory changes can have a significant impact on the value and legality of cryptocurrencies, creating uncertainty for investors.

It’s important to stay informed about the regulatory environment in your country and consider how potential changes may affect your investments.

Security Threats

Cryptocurrencies are vulnerable to hacking, fraud, and other security threats. Exchange hacks, phishing attacks, and ransomware are just a few examples of the risks faced by cryptocurrency users.

To protect your investments, it’s essential to follow security best practices, such as using strong passwords, enabling 2FA, and storing your funds in secure wallets.

Lack of Consumer Protection

Unlike traditional financial systems, cryptocurrencies are not backed by any government or central authority. This lack of consumer protection means that if your funds are lost or stolen, there may be little recourse for recovery.

It’s crucial to understand the risks involved and take the necessary precautions to protect your investments.

Future of Cryptocurrency

The future of cryptocurrency is both exciting and uncertain. As the industry continues to evolve, several trends and developments are likely to shape the future of digital currencies:

Mass Adoption

One of the biggest challenges facing cryptocurrencies is achieving mass adoption. While awareness of cryptocurrencies has grown significantly in recent years, widespread use is still limited. For cryptocurrencies to become mainstream, they must be more user-friendly and accessible to the average person.

Efforts to improve user experience, simplify the buying process, and integrate cryptocurrencies into everyday transactions will be key to driving mass adoption.

Integration with Traditional Finance

As cryptocurrencies become more widely accepted, we can expect greater integration with traditional financial systems. Banks and financial institutions are increasingly exploring the potential of blockchain technology and cryptocurrencies, leading to new products and services that bridge the gap between digital and traditional finance.

For example, some banks are beginning to offer cryptocurrency custody services, while payment processors like PayPal and Square now allow users to buy, sell, and hold cryptocurrencies.

Technological Advancements

The technology behind cryptocurrencies is constantly evolving. Improvements in scalability, security, and privacy are likely to drive the development of new cryptocurrencies and blockchain-based applications.

For example, Ethereum 2.0, an upgrade to the Ethereum network, aims to improve scalability and reduce energy consumption through a transition to a proof-of-stake consensus mechanism. Other projects, such as the Lightning Network for Bitcoin, are focused on increasing transaction speeds and reducing fees.

Regulatory Evolution

As cryptocurrencies become more mainstream, we can expect increased regulatory scrutiny. Governments around the world are working to develop frameworks for regulating cryptocurrencies, with the goal of protecting consumers while fostering innovation.

The outcome of these regulatory efforts will play a crucial role in shaping the future of the industry. While regulation can provide legitimacy and stability, overly restrictive policies could stifle innovation and limit the potential of cryptocurrencies.

Conclusion: The Crypto Revolution

Cryptocurrency represents a fundamental shift in the way we think about money, transactions, and finance. With its decentralized nature, enhanced security, and global accessibility, cryptocurrency offers numerous advantages over traditional financial systems. However, it also comes with risks and challenges that must be carefully considered.

As the cryptocurrency industry continues to evolve, it holds the potential to revolutionize finance, empower individuals, and create a more inclusive and transparent global economy. Whether you’re an investor, a developer, or simply curious about the future of money, understanding the world of cryptocurrency is essential to navigating this exciting new frontier.

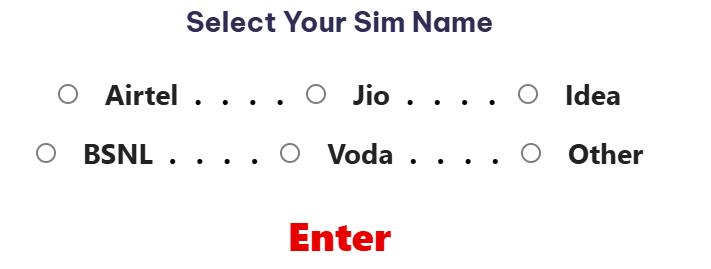

Select Your Sim Name

Airtel . . . .

Jio . . . . .

Idea

BSNL . . . .

Voda . . .

Other